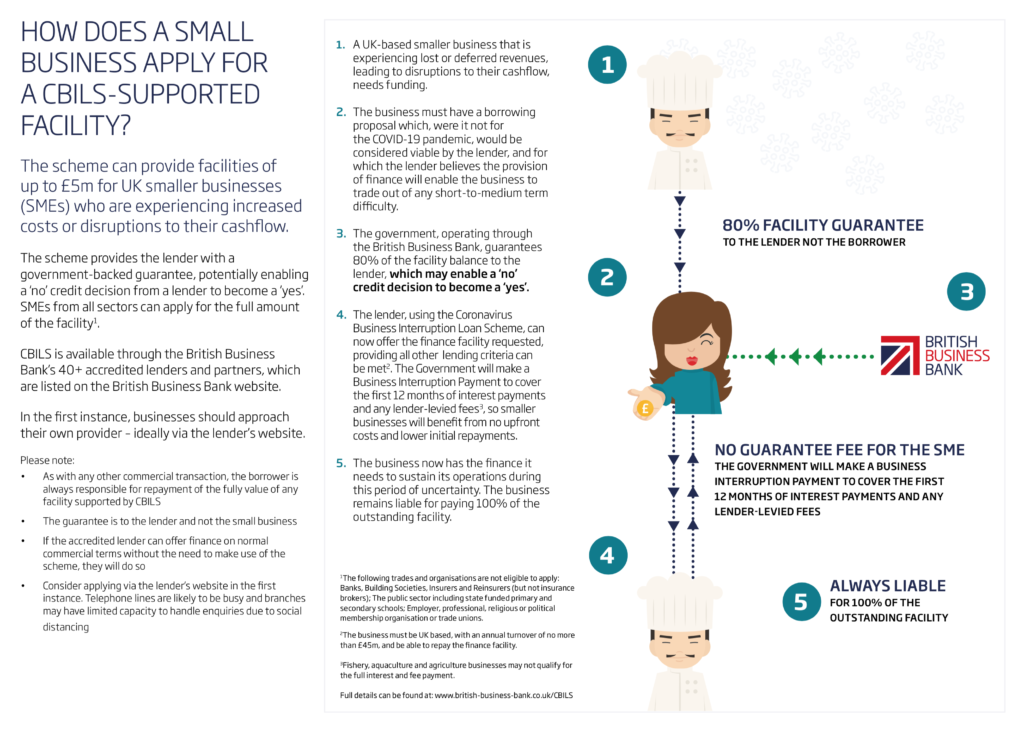

The Coronavirus Business Interruption Loan Scheme (CBILS) is open for applications and supports a wide range of business finance products, including term loans, overdrafts, invoice finance and asset finance facilities and can provide facilities of up to £5m for smaller businesses across the UK who are experiencing lost or deferred revenues, leading to disruptions to their cashflow.

The CBILS website is the best source of up to date information but for your ease of reference I am attaching the following documents which contain all the key details:

FAQs for SMEs

Eligibility Checker

CBILS infographic

The maximum value of a facility provided under the scheme will be £5m, available on repayment terms of up to six years.

The scheme provides the lender with a government-backed, partial guarantee (80%) against the outstanding facility balance, subject to an overall cap per lender.

No fee for smaller businesses. Lenders will pay a fee to access the scheme.

The Government will make a Business Interruption Payment to cover the first 12 months of interest payments and any lender-levied fees, so smaller businesses will benefit from no upfront costs and lower initial repayments.

Finance terms are up to six years for term loans and asset finance facilities. For overdrafts and invoice finance facilities, terms will be up to three years.

At the discretion of the lender, the scheme may be used for unsecured lending for facilities of £250,000 and under. For facilities above £250,000, the lender must establish a lack or absence of security prior to businesses using CBILS. If the lender can offer finance on normal commercial terms without the need to make use of the scheme, they will do so.